washington state capital gains tax vote

Amazon shareholders approve 201 stock split vote down record 15 proposals at annual meeting. During Saturdays vote in the Senate the capital gains tax legislation sponsored by Sen.

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Heading into session there were two proposals for a capital gains tax HB 1496 in the state House and another in the state Senate SB 5096 requested by the Office of Financial Management which.

. March 1 2022 at 838 pm. While only three amendments passed none was more consequential than Sen. But to actually repeal that tax we need Jim Walshs Initiative 1408 on the November 2022 ballot.

An advisory vote on Washington states new capital gains tax on high-profit assets was failing after an initial round of election results were released Nov. The Sunday vote on the capital gains bill mostly along party lines primarily targets stock and business ownership sales with a 7 tax for the first time in. Washington states new capital gains tax ruled unconstitutional by lower court.

OLYMPIA Profits on the sale of stocks and bonds in excess of 250000 would be subject to a new tax on capital gains under a bill narrowly approved Saturday by the Washington Senate. This initiative would repeal a 7 capital gains tax that was set to begin being collected in 2023. This tax increase should be.

Beginning January 1 2022 Washington state has instituted a 7 capital gains tax on Washington long-term capital gains in excess of 250000. June Robinson faced nineteen floor amendments. The bill imposes a seven percent tax on capital gains in excess of 250000 realized from the.

Washington Advisory Vote 37 was a question to voters on whether to maintain the capital gains income tax increase passed by the Legislature during the 2021 session. ___ Repealed ___ Maintained. The answer from voters by a wide margin was no with a vote of 63 to 37.

In an advisory vote on this years general election ballot voters across the state said by a nearly 63 to 37 margin that the states new 7 capital gains tax should not be approved. Washingtons advisory votes are. The sponsor filed multiple versions of the initiative and some.

DJ Wilson March 10 2021. State Measures - Advisory Vote No. Under the unusual dynamics of the COVID-19.

By contrast the capital gains tax proposed by Gov. 37 asking whether the tax increase should be maintained or repealed is non-binding. The Washington state Senate is expected to debate and vote on a bill Saturday to establish a new capital gains tax.

Bill sponsors say fewer. Washington State Representative Jim Walsh R-Aberdeen issued the following statement on the. Advisory Vote 37.

After several hours of debate the House passed the Senates capital gains tax bill Wednesday in a 52-46 vote bringing Democrats one step closer to rebalancing Washingtons tax code. The legislature imposed without a vote of the people a 7 tax on capital gains in excess of 250000 with exceptions costing 5736000000 in its first ten years for government spending. The repeal side of an advisory vote on a capital gains tax approved by the state Legislature is out to an early lead following Tuesday nights.

AP A judge has overturned a new capital gains tax on high profit stocks bonds and other assets that was approved by the Washington Legislature. The realization of capital gains slid 71 percent between 2007 and 2009 55 percent in 1987 and 46 percent in 2001. I-1408 prohibits any tax based on personal income whether called payroll taxes excise taxes or any other name and it expressly repeals the excise tax on capital gains in ESSB 5096 see section 3 of I-1408.

Steve Hobbss amendment 413 which removed the emergency clause from the underlying bill. Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income. The Washington Repeal Capital Gains Tax Initiative may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022.

Delving Into the New 7 WA State Capital Gains Tax. OLYMPIA Washington voters were rejecting a state advisory measure to adopt a new 7 tax on capital gains above 250000 in Tuesday nights election results. Voters in 38 of 39 Washington counties told the Legislature that they do not approve of the states new capital gains tax.

The Center Square Voters in Washington state will get their chance to weigh in Tuesday at least symbolically on the controversial new capital gains income tax set to go into effect on Jan. Jay Inslee in December is estimated to raise 875 million per year at a rate of 9. The 25 margin of disapproval was far larger than the.

The capital gains tax would not start until 2022 with taxes to be paid in 2023. The bill now heads back to the Senate for final concurrence. Of course all the states Office of Financial Management can do is assume that capital gains will increase every year whereas in practice capital gains are exceedingly volatile.

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

How Does The Deduction For State And Local Taxes Work Tax Policy Center

New State Laws For 2022 Expand Voting Rights Create Capital Gains Tax And More South Seattle Emerald

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

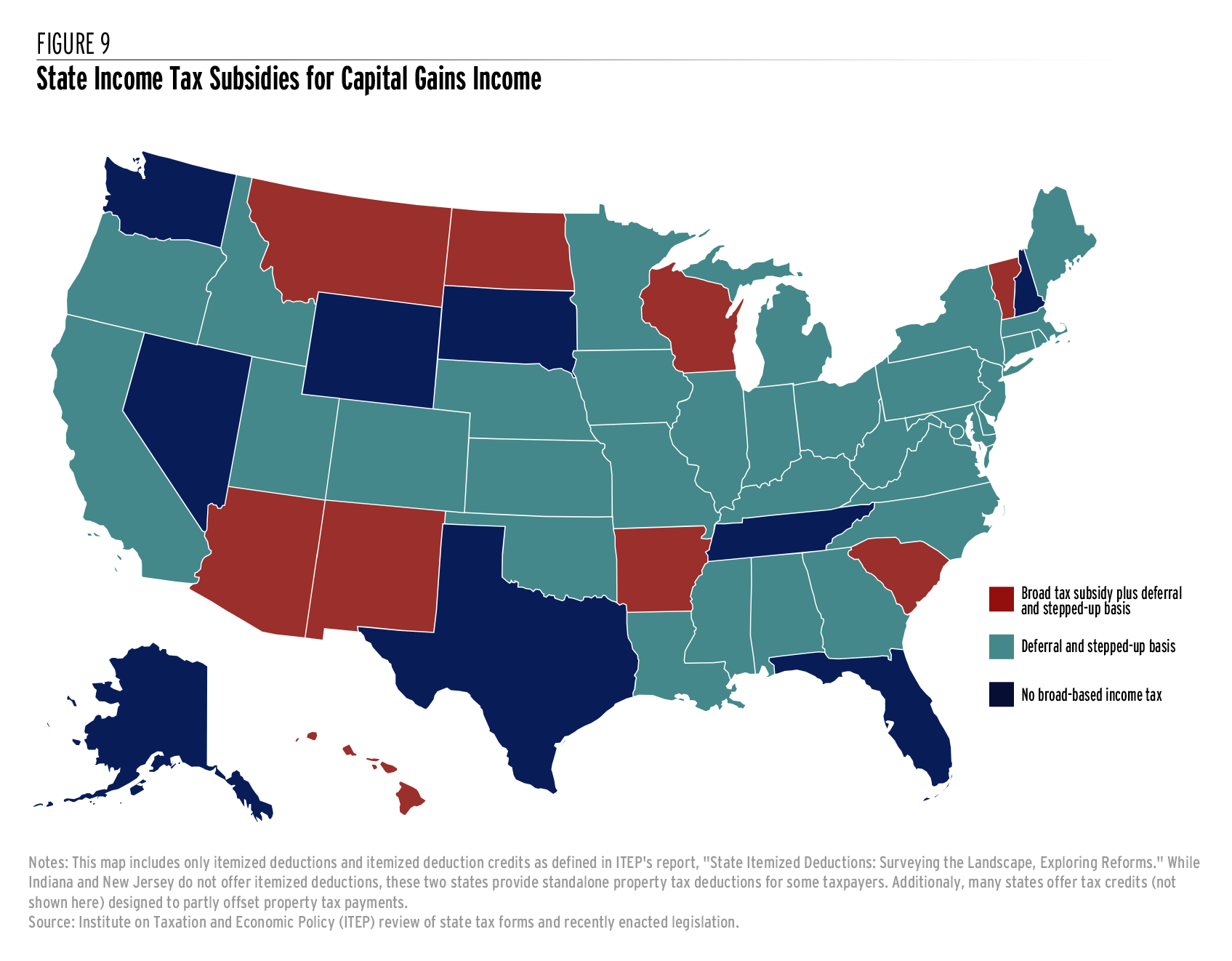

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Taxation As It Applies To 1031 Exchanges

Washington State Kicks Off Major Tax Fight With New Capital Gains Levy The Hill

Judge Clears Way For Initiative To Repeal Washington Capital Gains Tax

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Vqt Bell The Cat Job Creation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

In A Blow To Progressives Douglas County Court Strikes Down Wa S New Capital Gains Tax The Seattle Times

A History Of Washington State S Tax Code All In For Washington

Usa East West Division 4 Methods Map Amazing Maps American History Timeline

State Taxation As It Applies To 1031 Exchanges

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

The Real Capital Gains Tax Repeal Initiative Appears Washington State Wire